Do you want to act now? Do you wish to pass on part of your assets during your lifetime, and get to see the effect of your contribution? Then make a donation!

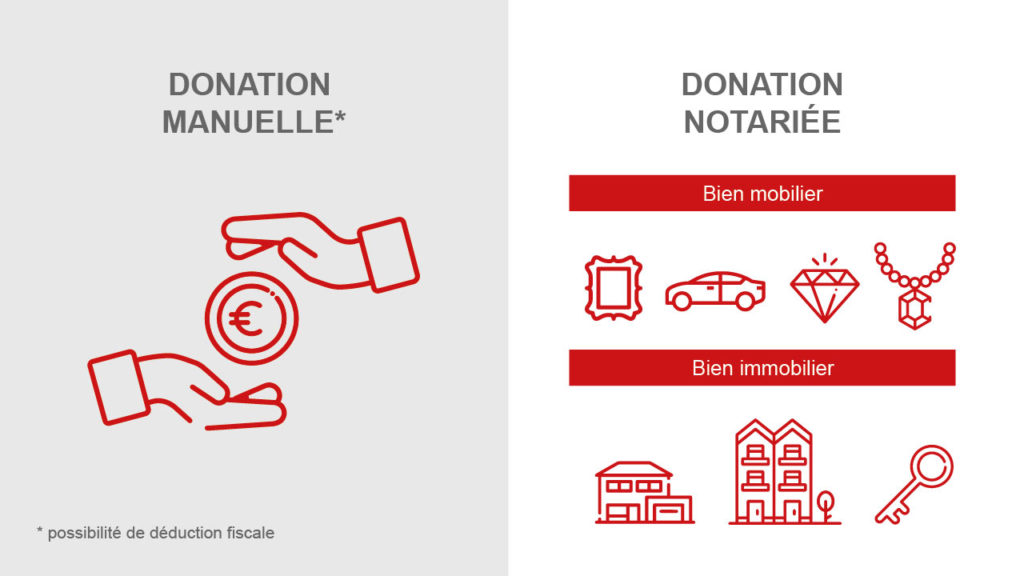

Any property can be subject to donation. Depending on the nature of the property, there are two types of donation: a “manual” donation and a “notarized” donation.

Manual donations are the most conventional and the most widely used. They consist in giving money and do not require a notarial deed. In order for your donation to be tax-deductible as a special expense, the sum total of the donations you make must be greater than or equal to €120 and must not exceed 20% of your total net income or an amount of €1,000,000. Donations exceeding these ceilings may be carried forward to the next two years.

Notarized donations apply in principle to all movable property (jewellery, works of art, cars, paintings, securities, etc.) and immovable property (a house, an apartment or land).

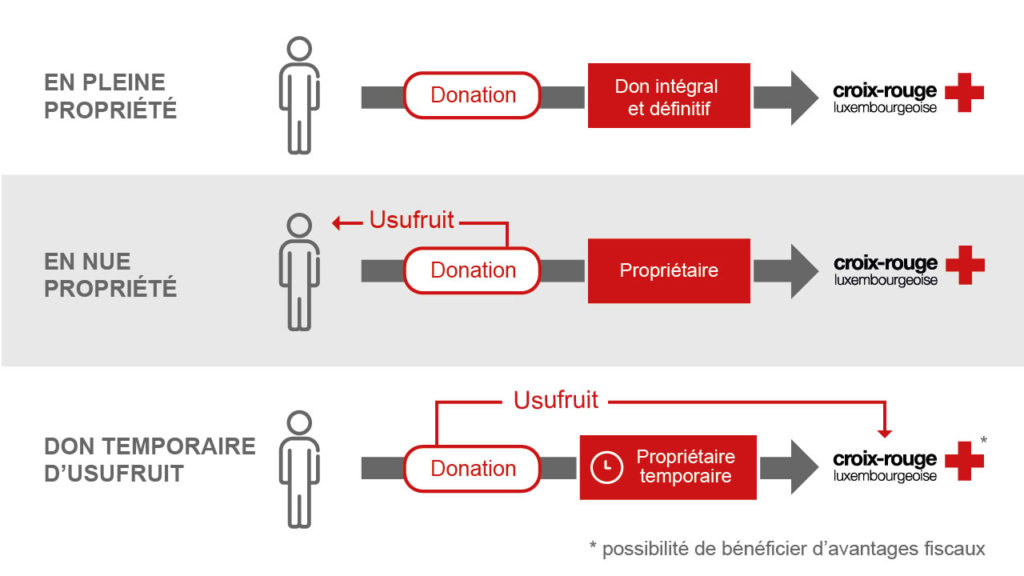

There are several options available to you.

A full ownership donation. You give your property in full and definitively to the Luxembourg Red Cross.

A bare ownership donation. You transfer the property to the Luxembourg Red Cross but you retain usufruct for yourself or for another person you have designated. This formula is particularly practical for buildings. For instance, for an apartment, the Luxembourg Red Cross becomes the owner, but you can continue to occupy it or collect the rent during your lifetime.

A temporary usufruct donation. You retain ownership of the property but you give the usufruct to the Luxembourg Red Cross for a fixed period of time. Temporarily transferring income to the Red Cross in this way may provide tax benefits. In such a case, you could indeed change tax brackets and make substantial savings on income tax.